The Dow Jones Industrial Average dropped by a record 1,175.21 points on Monday, prompting widespread panic among the usually serene and thoughtful users of Facebook, Inc. (NASDAQ:FB) and Twitter Inc (NYSE:TWTR).

Among the gems I saw:

“Great economy?? I don’t think so! The Dow dropped 1,125 today biggest drop in history.”

“DOW loses another 5 percent today to again become the worst fall since 2008 and the largest single-day point drop ever recorded. “

“It was the scariest day on Wall Street in years.”

I also saw a video on Facebook of a guy trying to break a car window by ramming it repeatedly with his head — he was the smart one.

Look, I know it’s popular these days to rant and rave on social media (I particularly enjoy vague posts about deeply personal issues), but let me mix in a little reason amongst the weeping and gnashing of teeth.

Look, I know it’s popular these days to rant and rave on social media (I particularly enjoy vague posts about deeply personal issues), but let me mix in a little reason amongst the weeping and gnashing of teeth.

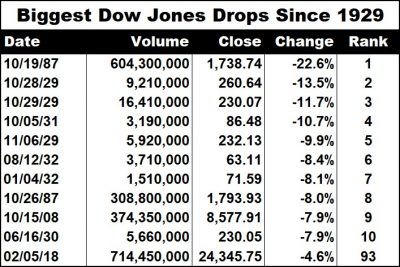

To begin with the record point drop means nothing — zero, zip, zilch. It’s akin to comparing the price of bread today with the price of bread 50-100 years ago. It’s the percentage drop that matters and, on that basis, Monday’s 4.6 percent Dow decline ranks as the 93rd greatest since 1929. By way of comparison, the Dow plunged 22.6 percent on Oct. 19, 1987, and a combined 25.2 percent on back-to-back days in October of 1929, helping to trigger the Great Depression.

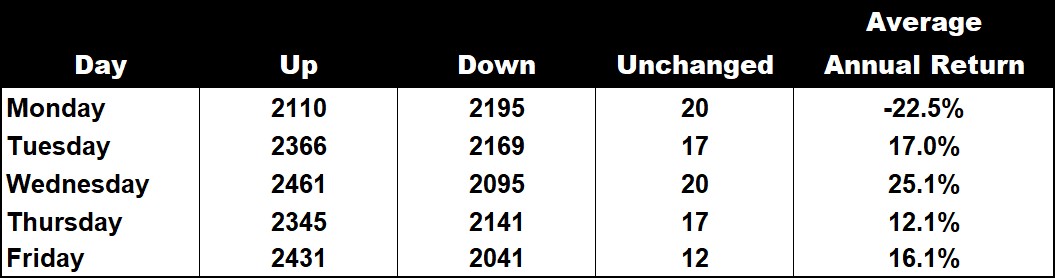

And it’s not like a big Monday correction is unprecedented. Among the top 25 Dow declines since 1929 — once again, we’re talking percentages here — 13 occurred on the first trading day of the week. This includes three of the top five and six of the top 10. In fact, over the past 89 years, Monday is the only trading day of the week that has averaged a loss.

There’s something else for doomsayers to consider too. Since the end of World War II, single-day Dow declines of 3 percent or greater produced a Dow increase the next trading day in 55 of 97 instances (56.7 percent), good for an average annualized return of 80.8 percent*.

Obviously, none of this means that investors should ignore Monday’s drop altogether. Most experts agree that the markets have been overvalued for some time now and that a correction was long overdue (have you checked the price of bitcoin recently?). And there could be more pain before there is more gain.

But there is a difference between internet-induced hysteria and a reasoned analysis of current events. Monday’s Dow meltdown is not a sign that rivers will soon be running red or that the skies will shortly be filled with swarming locusts. It was a needed correction — nothing more, nothing less.

Will the Dow go up from here? I don’t know. Will it drop even further? I don’t know. What I do know is that Monday’s action is not a cause for panic — despite what you may hear on social media.

*Average annual return is based on 365.25 days per year, not the number of individual trading days.